Unlocking Financial Flexibility: Bajaj Finserv EMI Network Card Benefits and How to Make the Most of It

Introduction: In an era where financial flexibility and convenience reign supreme, the Bajaj Finserv EMI Network Card emerges as a powerful tool, offering a plethora of benefits that cater to the modern consumer's needs. This card has rapidly gained prominence as an essential financial companion, simplifying purchases and transforming the way people manage their expenses. In this blog, we will delve into the advantages of the Bajaj Finserv EMI Network Card, explore how to use it effectively, and understand why it holds immense importance in today's fast-paced world.

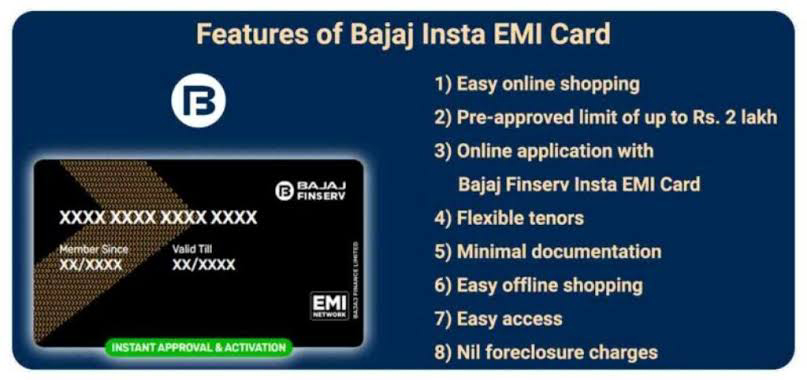

Benefits of Bajaj Finserv EMI Network Card:

Zero Down Payment: One of the standout features of this card is the convenience of purchasing high-value items without shelling out a hefty upfront amount. The card allows you to enjoy zero or minimal down payments on a wide range of products, making big-ticket purchases more accessible.

Flexible Repayment Options: The Bajaj Finserv EMI Network Card empowers you with flexible repayment options. You can choose from a variety of tenures to pay off your purchases, ensuring that your financial commitments align with your budget and cash flow.

Wide Network of Retail Partners: This card opens doors to a vast network of partner stores across categories like electronics, appliances, fashion, healthcare, and more. With thousands of options at your disposal, you can shop for your desired products without compromise.

No-Cost EMI: The card offers the unique advantage of no-cost EMI, allowing you to divide your purchase into affordable installments without incurring any additional interest or charges. This feature is especially attractive for those seeking cost-effective ways to manage their expenses.

Instant Approval and Activation: Applying for the Bajaj Finserv EMI Network Card is a hassle-free process. The card is instantly approved and activated, ensuring that you can start using it right away to seize lucrative deals and offers.

Exclusive Offers and Discounts: Cardholders are privy to exclusive deals, discounts, and cashback offers at partner stores. These special promotions make shopping not only convenient but also more economical.

How to Use the Bajaj Finserv EMI Network Card: Using the Bajaj Finserv EMI Network Card is straightforward:

Select a Partner Store: Choose from the extensive list of partner stores that accept the Bajaj Finserv EMI Network Card.

Choose Your Product: Pick the product you want to buy and inquire about the EMI options available. The card can be used for various categories like electronics, appliances, fashion, travel, and healthcare.

Swipe or Online Payment: Present your card to the cashier for swiping or use the card details for an online transaction. Choose the EMI option that suits you best.

Complete the Purchase: Once the transaction is successful, your purchase will be converted into EMI, and you can enjoy your product without the burden of a lump-sum payment.

Importance in Today's Context: In the rapidly evolving financial landscape, the Bajaj Finserv EMI Network Card stands out as a lifeline for many reasons:

- Financial Control: It provides better control over finances by enabling planned purchases within budgeted EMI options.

- Emergency Expenses: The card can be a savior during unexpected situations, allowing you to manage essential expenses conveniently.

- Avoiding Debt: It helps avoid accumulating credit card debt, thanks to its transparent EMI structure.

- Accessibility: The wide partner network ensures that people from various walks of life can benefit from its features.

- Enhanced Lifestyle: With the card, you can elevate your lifestyle by acquiring quality products without straining your finances.

Eligibility Criteria for Bajaj Finserv EMI Network Card:

The Bajaj Finserv EMI Network Card is designed to cater to a wide range of individuals, making it accessible to a diverse set of customers. The eligibility criteria for obtaining the card are generally straightforward, and the card is available for both existing customers and new applicants. Here's an overview of who is eligible for the Bajaj Finserv EMI Network Card:

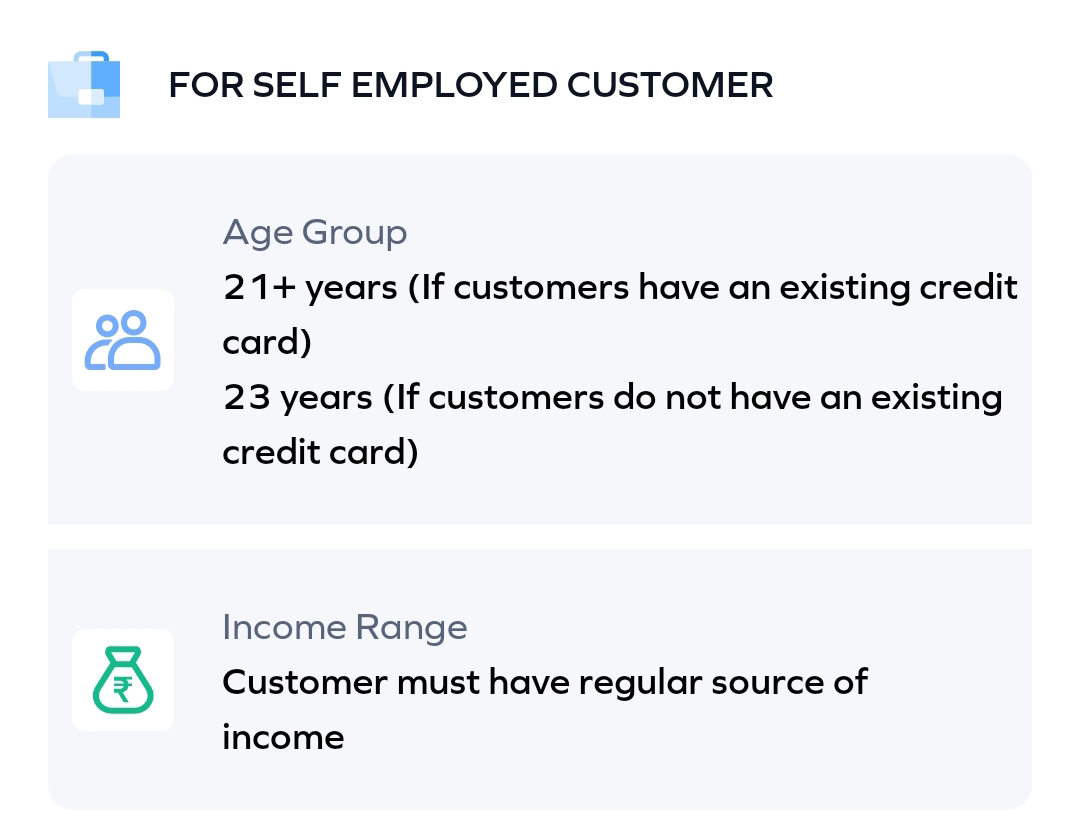

Age Requirement: Applicants should be within the age range specified by Bajaj Finserv, typically between 21 to 60 years. The exact age limits may vary and are subject to the company's policies.Employment Status: Both salaried individuals and self-employed individuals are generally eligible for the Bajaj Finserv EMI Network Card. This includes individuals with regular income as well as those with variable income sources.

Credit Score: While a good credit score can enhance your chances of approval, the Bajaj Finserv EMI Network Card is often designed to accommodate individuals with varying credit histories. This is one of the factors that distinguishes it from traditional credit cards.

Documentation: Applicants will need to provide standard documentation, including identity proof, address proof, and income-related documents. The specific documents required can vary based on the applicant's employment type and location.

Residential Status: The card is generally available for Indian residents. Non-resident Indians (NRIs) may not be eligible to apply.

Existing Bajaj Finserv Customers: If you're an existing customer of Bajaj Finserv with a good track record of payments and transactions, you may have an advantage in obtaining the EMI Network Card.

It's important to note that the eligibility criteria may evolve over time based on the company's policies and market conditions. To ensure accurate and up-to-date information, it's recommended to visit the official Bajaj Finserv website or contact their customer support for the most recent eligibility guidelines.

Step 1: Research and Preparation: Before you begin the application process, it's a good idea to research the benefits and features of the Bajaj Finserv EMI Network Card. Make sure you understand how the card works, its eligibility criteria, and the documents you'll need to provide.

Step 2: Choose the Application Method: Bajaj Finserv offers multiple methods to apply for the EMI Network Card. You can choose the one that suits you best:

Online Application: Click the Apply Button for Bajaj Finserv Card and navigate to the EMI Network Card section. Look for the "Apply Now" or "Get Started" button to begin the online application process.

Offline Application: You can also apply for the card by visiting a Bajaj Finserv partner store or branch. The store staff or branch representatives will assist you with the application process.

Step 3: Online Application Process: If you're applying online, follow these steps:

Click on the Button: Go to the Bajaj Finserv official website.

Navigate to EMI Network Card Section: Look for the section related to the EMI Network Card. This is usually prominently displayed on the homepage.

Initiate the Application: Click on the "Apply Now" or "Get Started" button to initiate the application process.

Fill in Personal Details: Provide your personal information, including your name, date of birth, contact details, and email address. Make sure to double-check the accuracy of the information.

Select EMI Plan: Choose the EMI plan that suits your preferences. This includes selecting the desired tenure and down payment options.

Upload Documents: You'll need to upload the required documents. These typically include identity proof (such as Aadhar card, passport, or driver's license), address proof (such as Aadhar card, utility bill, or rental agreement), and income-related documents (such as salary slips or bank statements).

Submit Application: Review the information and documents you've provided. If everything is accurate, submit the application.

Step 4: Offline Application Process: If you prefer to apply offline, visit a Bajaj Finserv partner store or branch:

Locate a Store or Branch: Find a Bajaj Finserv partner store or branch near you. You can use the store locator on the official website.

Visit the Store/Branch: Visit the selected store or branch in person.

Fill the Application Form: Collect the application form from the store or branch and fill it out with accurate information.

Submit Documents: Provide the necessary documents, including identity proof, address proof, and income-related documents, along with the filled application form.

Verification: The store/branch representatives will review your application and documents for verification.

Step 5: Approval and Card Delivery: After submitting your application and documents, the approval process may take a few minutes to a few working days, depending on the verification process. Once your application is approved:

Online Application: If you applied online, you might receive an approval notification via email or SMS. The card details, such as card number and limit, will be provided.

Offline Application: If you applied offline, the store/branch representative will inform you about the approval and card details.

Step 6: Using the Card: Once you receive your Bajaj Finserv EMI Network Card, you can start using it for purchases at partner stores. Simply present the card at the time of purchase, choose your preferred EMI plan, and complete the transaction.

The time it takes to receive your Bajaj Finserv EMI Network Card can vary depending on factors such as the application method, verification process, and the specific processes of Bajaj Finserv. Generally, here's what you can expect in terms of the timeline:

Online Application:

- If your application is approved quickly and all the required documents are in order, you might receive the card details (like the card number and limit) within a few minutes to a few hours after the approval.

- Physical card delivery might take a bit longer, typically within 7 to 15 business days, depending on your location and the delivery services.

Offline Application:

- When you apply in person at a Bajaj Finserv partner store or branch, the approval process and card delivery time can vary.

- If your application is approved on the spot and all necessary documents are verified, you might receive the card immediately at the store/branch.

- If there's any delay in verification or approval, it might take a few days to a couple of weeks to receive your card.

It's important to note that these timelines are approximate and can vary based on the efficiency of the verification process, the volume of applications, your location, and other logistical factors. Bajaj Finserv often provides updates on the application status and delivery through notifications via SMS or email, so be sure to keep an eye on your communication channels for any updates.

If you have a specific timeline requirement or if you're concerned about the delay in receiving your card, you can always reach out to Bajaj Finserv's customer support for more accurate information on the status of your application and card delivery.

The Bajaj Finserv EMI Network Card offers a unique advantage of no-cost EMI, which means that you generally won't have to pay any interest on your purchases if you use the card within the specified EMI tenure. This is one of the key benefits of the card that sets it apart from traditional credit cards.

Here's how the no-cost EMI feature works:

No Interest: When you make a purchase using the Bajaj Finserv EMI Network Card and choose an EMI plan, the total cost of the product is divided into equal monthly installments (EMIs). Importantly, there is no additional interest charged on these EMIs.

Transparent EMI Structure: The no-cost EMI structure ensures transparency in payments. The EMI amount you pay each month includes only the product's cost divided by the chosen EMI tenure. There are no hidden charges or interest components added.

Benefits of No-Cost EMI: This feature is particularly beneficial for customers looking to make high-value purchases without the burden of interest charges. It allows you to budget your expenses effectively and pay for your purchases in convenient installments.

It's important to keep in mind that while you won't incur interest charges on the no-cost EMI transactions, there might be other charges associated with the card or specific purchases. For example, some merchants might charge processing fees or nominal charges for offering EMI options. It's recommended to review the terms and conditions associated with your specific EMI transactions to fully understand the costs involved.

Remember that the no-cost EMI feature applies when you use the card within the EMI tenure. If you miss EMI payments or choose a longer tenure than the offer's specified no-cost period, there might be interest or charges applicable. Always review the terms and conditions provided by Bajaj Finserv or the merchant before making a purchase to ensure you have a clear understanding of the costs involved.

The available credit limit on the Bajaj Finserv EMI Network Card can vary based on a variety of factors, including your creditworthiness, income, repayment history, and Bajaj Finserv's policies. The credit limit determines the maximum amount you can spend using the card for EMI-based purchases.

Generally, Bajaj Finserv provides credit limits that align with your financial profile and the purchases you intend to make. This credit limit can range from a few thousand rupees to several lakhs, depending on your financial standing and the criteria set by Bajaj Finserv.

Here are a few factors that can influence the credit limit on your Bajaj Finserv EMI Network Card:

Income: A higher monthly income might result in a higher credit limit, as it indicates your capacity to repay.

Credit History: If you have a good credit history with Bajaj Finserv or other financial institutions, you might be offered a higher credit limit.

Existing Relationship: If you're an existing customer of Bajaj Finserv with a positive history of timely repayments, you could be eligible for a higher credit limit.

Documentation: The accuracy and completeness of the documents you provide during the application process can also impact the credit limit assigned to your card.

Affordability: Bajaj Finserv takes into consideration your affordability, ensuring that the credit limit aligns with your income and existing financial commitments.

To know your specific credit limit, it's recommended to check with Bajaj Finserv directly or refer to the communication you receive upon approval of your EMI Network Card application. Keep in mind that your credit limit might also change over time based on your usage, payment behavior, and the company's evaluation of your financial profile.

For help and support regarding the Bajaj Finserv EMI Network Card, you can reach out to their customer service. Here's how you can get assistance:

1. Customer Service Helpline: You can call Bajaj Finserv's customer service helpline to speak with a representative who can provide information, address your queries, and assist you with any issues you might be facing. The helpline number is usually available on the official Bajaj Finserv website or on the documentation you've received.

2. Official Website: Visit the official Bajaj Finserv website to find comprehensive information about the EMI Network Card, its features, benefits, application process, and frequently asked questions. The website might also have a "Contact Us" or "Customer Support" section that provides additional ways to get in touch.

3. Live Chat: Many companies offer live chat support on their websites. Check if Bajaj Finserv provides this option, where you can chat with a customer service representative in real time to get immediate assistance.

4. Social Media: Bajaj Finserv might have active social media profiles on platforms like Facebook, Twitter, and Instagram. You can use these platforms to reach out for support or to ask questions.

5. Email: You may be able to find an email address on their official website for customer support inquiries. Sending an email with your queries or concerns can be another way to seek assistance.

6. Visit a Branch: If you're comfortable with in-person communication, you can visit a Bajaj Finserv branch near you and speak with their representatives face-to-face for assistance.

Before reaching out, make sure to gather any relevant details such as your application reference number (if applicable), card number, and any specific questions you have. This will help the customer service team assist you more effectively.

Remember that the customer support team is there to help answer your questions, guide you through any processes, and provide solutions to any issues you might encounter related to your Bajaj Finserv EMI Network Card.

The Bajaj Finserv EMI Network Card is widely accepted across India and can be used in numerous states and districts. While I don't have an exhaustive list of all states and districts, I can provide you with a general overview of where the card is likely to be accepted.

The card is accepted in thousands of partner stores across various categories such as electronics, appliances, fashion, healthcare, travel, and more. These partner stores are located in cities and towns across India. Major metropolitan cities, urban centers, and even smaller towns typically have a network of partner stores where you can use the Bajaj Finserv EMI Network Card for purchases.

Here are the names of some states and major cities where you can expect the card to be accepted:

States:

MaharashtraKarnataka

Tamil Nadu

Delhi

Gujarat

Uttar Pradesh

Rajasthan

Andhra Pradesh

Telangana

Kerala

West Bengal

Punjab

Haryana

Madhya Pradesh

Bihar

Please note that this is not an exhaustive list, and the Bajaj Finserv EMI Network Card is likely accepted in many more states and districts across India.

To get a comprehensive list of partner stores and locations where the card can be used, it's recommended to visit the official Bajaj Finserv website. They often provide store locators or directories that can help you find specific partner stores near your location. Additionally, you can inquire at local retail outlets or visit the nearest Bajaj Finserv branch for more information about the network's coverage.