Meta Description: Looking for a personal loan? Discover the benefits of IndusInd Bank Personal Loan, offering loan amounts up to ₹50 lakh with speedy approval and a 100% online application process. Find out more about eligibility criteria, important terms and conditions, and get answers to frequently asked questions. Apply today for a collateral-free loan!

Introduction:

Are you in need of immediate funds for your personal needs? IndusInd Bank offers an attractive personal loan with flexible loan amounts ranging from ₹30,000 to ₹50 lakh and convenient repayment tenures from 12 to 60 months. With a hassle-free 100% online application process and minimal documentation requirements, getting the financial assistance you need has never been easier. Read on to explore the benefits, eligibility criteria, important terms and conditions, and answers to frequently asked questions about IndusInd Bank Personal Loan.

Brand Benefits:

1. Loan Amount - IndusInd Bank offers a wide range of loan amounts from ₹30,000 to ₹50 lakh, allowing you to borrow according to your specific requirements.

2. Tenure - Choose a repayment tenure that suits your financial situation, ranging from 12 to 60 months, ensuring comfortable and convenient loan repayment.

3. Application Process - Enjoy the convenience of a 100% online application process, saving you time and effort. IndusInd Bank ensures a seamless and user-friendly experience to make applying for a personal loan hassle-free.

4. Minimal Documentation - Say goodbye to piles of paperwork! IndusInd Bank requires minimal documentation, making the loan application process quick and straightforward.

5. Interest Rates - Benefit from competitive interest rates, ranging from 10.49% to 29.50% p.a. The rates are designed to be affordable, giving you peace of mind during the loan repayment period.

6. Disbursal - IndusInd Bank understands the importance of quick disbursal. With a speedy approval process, you can expect fast loan disbursal, enabling you to address your financial needs promptly.

7. Collateral-Free Loan - IndusInd Bank Personal Loan is offered without the requirement of collateral, providing you with the necessary funds without the hassle of pledging assets.

To apply for an IndusInd Bank Personal Loan, you need to meet the following eligibility criteria:

- Age: You should be at least 21 years old at the time of loan application and should not exceed 60 years (65 years for self-employed individuals) at loan maturity.

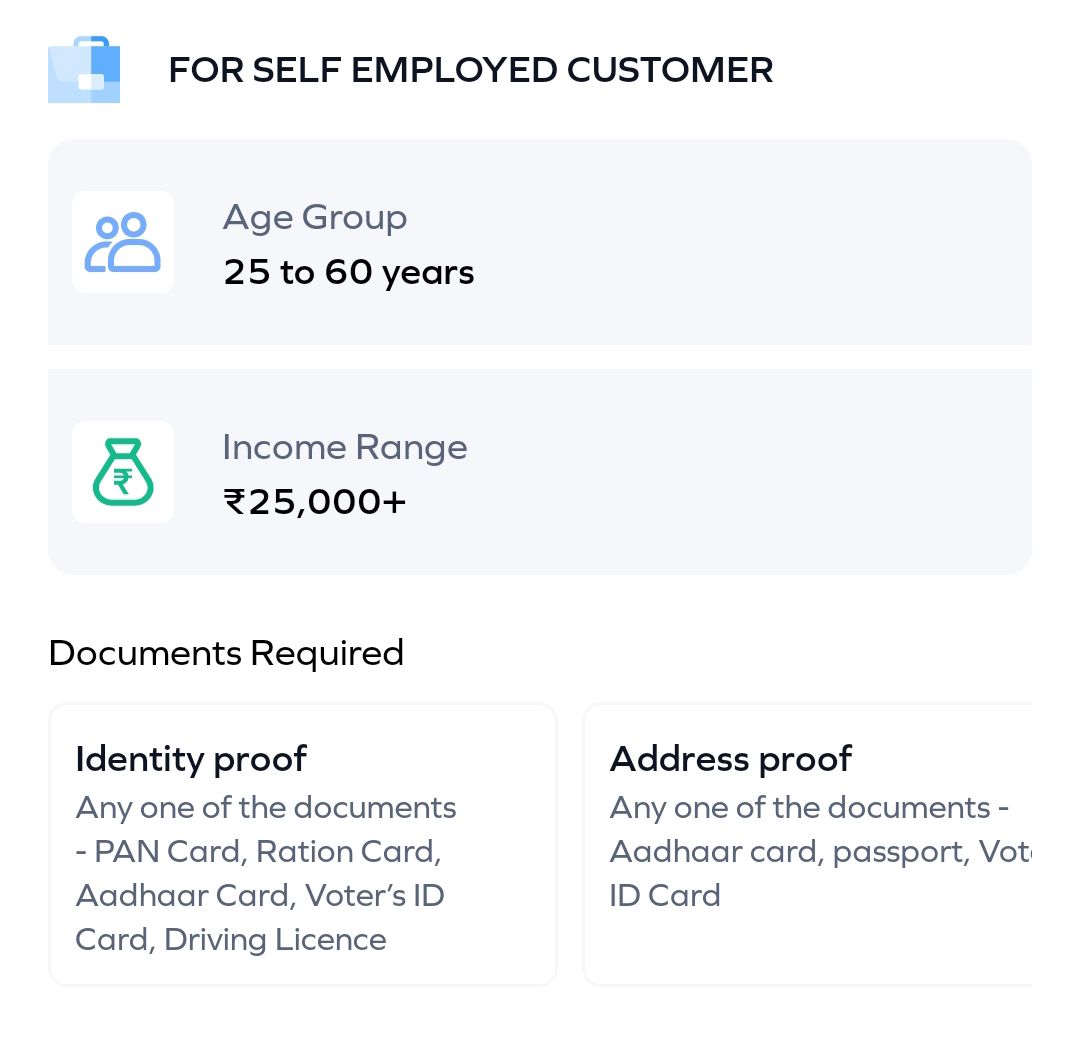

- Employment: Salaried individuals and self-employed professionals/business owners can apply.

- Income: The minimum income requirements vary based on your location and employment type. Check the bank's website for specific income criteria.

- Credit History: A good credit history will increase your chances of loan approval. A healthy credit score demonstrates your repayment capability and financial discipline.

1. Loan Repayment: Ensure timely repayment of the loan EMIs to avoid any negative impact on your credit score and to maintain a healthy financial track record.

2. Prepayment and Foreclosure: IndusInd Bank offers the flexibility of prepayment and foreclosure of the loan. However, specific terms and conditions may apply. Please refer to the bank's website for further details.

3. Interest Rates: The interest rates offered are based on various factors, including your creditworthiness, loan amount, and tenure. It's essential to check the prevailing rates and understand the impact on your monthly EMI before applying.

4. Fees and Charges: Familiarize yourself with the applicable fees and charges associated with the personal loan, such as processing fees, late payment charges, and others. Refer to the bank's official website for the complete list of charges.

FAQ:

Q1. What is the maximum loan amount offered by IndusInd Bank?

Ans: IndusInd Bank offers personal loans up to ₹50 lakh, providing ample funds to meet your financial requirements.

Q2. What is the tenure range for IndusInd Bank Personal Loan?

Ans: The repayment tenure for IndusInd Bank Personal Loan ranges from 12 to 60 months, allowing you to choose a suitable duration for repayment.

Q3. Can self-employed professionals apply for an IndusInd Bank Personal Loan?

Ans: Yes, self-employed professionals and business owners are eligible to apply for IndusInd Bank Personal Loan, subject to meeting the specified eligibility criteria.

Q4. How long does it take to get the loan amount disbursed?

Ans: IndusInd Bank ensures a speedy approval process, and once your application is approved, the loan amount will be disbursed quickly into your bank account.

If you have any further queries or need assistance with your IndusInd Bank Personal Loan application. Still have a Question? Contact Us

+91_7417274072

Conclusion:

IndusInd Bank Personal Loan provides a convenient and efficient solution for individuals in need of financial assistance. With loan amounts up to ₹50 lakh, speedy approvals, a 100% online application process, and attractive interest rates, IndusInd Bank ensures a seamless borrowing experience. Explore the eligibility criteria, important terms and conditions, and FAQs to gain a better understanding of the loan features. Apply for an IndusInd Bank Personal Loan today and secure the funds you need without any hassle or delays.